a clear path to reaching your retirement goals

Summitry - california's trusted financial advisors

Your Equity Compensation Choices Today Define Your Financial Future

Without the right guidance, equity compensation can lead to unexpected taxes, missed opportunities, and long-term financial setbacks.

Equity compensation can be one of the most powerful wealth-building tools at your disposal. Still, many professionals don’t have the time to understand how and when to take advantage of it. Without the right guidance, equity compensation can lead to unexpected taxes, missed opportunities, and long-term financial setbacks. Get expert advice before it’s too late. Whether you’re managing ISOs, RSUs, or ESPPs, questions around tax planning, when to exercise, or if and when to sell loom large.

Summitry is a Bay Area-based financial advisory firm that specializes in helping tech-sector professionals incorporate their stock into their bigger financial picture. Our team can provide the clarity and guidance you need to move forward with confidence, knowing your stock is working as hard as you are.

See the full picture of your equity

Without a coordinated plan, stock decisions made in isolation can create tax complications, missed timing opportunities, and overexposure to risk. At Summitry, we bring structure and insight to your equity decisions, helping you make the most of what you’ve earned.

Here are a few of the areas where we provide strategic guidance:

Timing option exercises and stock sales to minimize taxes

Avoiding missed PTE (Protective Tax Election) deadlines that could limit your tax planning flexibility

Preparing for AMT exposure with proactive tax planning

Managing liquidity and diversifying concentrated holdings

Coordinating with your CPA to avoid tax surprises

Planning for cash flow, retirement, and charitable giving

Navigating IPOs, tender offers, or secondary liquidity events

Client Stories

Tech Sector Loyalist Must Reduce Risk by Diversifying Concentrated Equity

Read more

Why Summitry

We help equity holders turn complex compensation into clear opportunities. From pre-IPO planning to managing a concentrated stock position, we’ll guide you through each decision, with your long-term financial health in mind. Our team works alongside CPAs and other financial professionals to deliver a unified strategy that helps you retain more of your wealth and move forward with a clear, purpose-driven financial roadmap.

-png.jpeg)

COMMON TYPES OF EQUITY COMPENSATION

We understand the complexity as tax laws shift and variables like income, timing, and risk tolerance come into play. The best strategy depends entirely on your individual circumstances. There is no one-size-fits-all approach. We can help you find the shoe that fits you best.

At Summitry, we’ve helped our clients from some of the top tech companies manage their stock options and build their financial future.

- Incentive Stock Options (ISOs)

- Non-Qualified Stock Options (NSOs)

- Restricted Stock Units (RSUs)

- Employee Stock Purchase Plans (ESPPs)

- Performance Shares and Awards

where our clients work

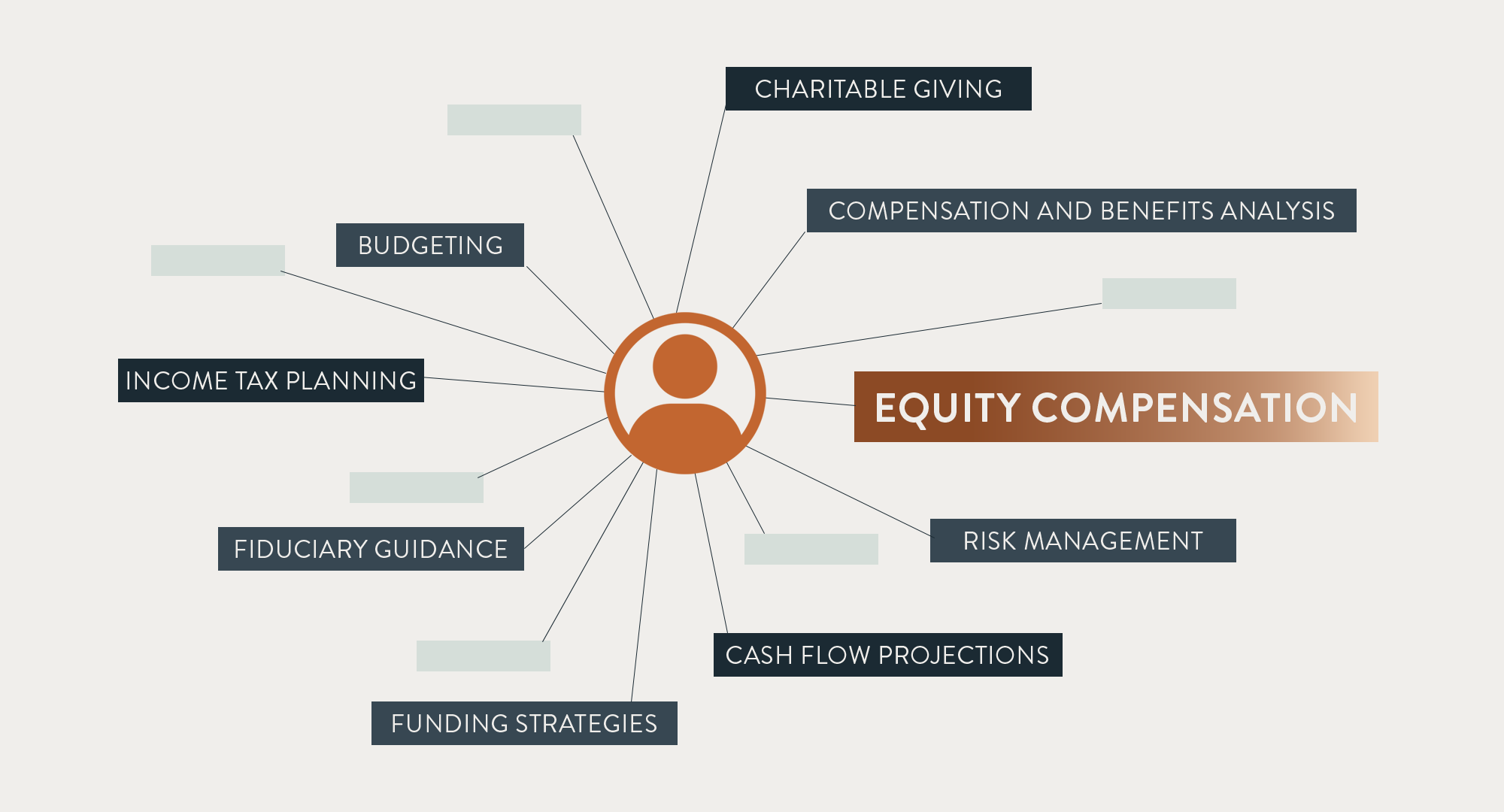

YOUR EQUITY DOESN'T EXIST IN A BUBBLE

Your equity compensation isn’t isolated. It’s one piece of a much larger financial picture. Investment strategy, retirement goals, estate planning, and education savings should all work in sync. That’s why we integrate equity compensation planning into your broader financial roadmap, so every part of your wealth is pulling in the same direction.

Strategic Wealth Planning for the Life You’re Working Toward

Summitry is a Bay Area-based wealth management firm focused on personalized planning and investment strategies that help entrepreneurs, equity holders, and high-net-worth individuals build the future they’ve worked hard for while navigating California’s complex tax landscape.

We believe in proactive, transparent, and strategic financial planning that gives you clarity, confidence, and peace of mind. Let’s put your equity to work for the life you want.

Live your best financial life with a coordinated financial strategy.

The securities identified and described do not represent all the securities purchased, sold, or recommended for clients' accounts. The reader should not assume that an investment in the securities identified was or will be profitable. This material is intended for general informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. It does not consider the specific investment objectives, tax and financial condition or needs of any specific person.

contact us